Cheap Rate Term Insurance - When to Invest

It does not seem long back when I would just sometimes encounter an ad for low-cost term life insurance. But more just recently these encounters seem to happen throughout almost any hour of a radio or television program. Unlike permanent (cash value) life insurance that is normally creatively sold or planned for, term insurance has actually become a product that customers usually acquire by themselves, without planning support. This column will certainly analyze term insurance and determine when its purchase is most suitable. I will certainly not clutter this piece with perhaps more imaginative planning alternatives or cover intrinsic prospective issues related to tax and other matters since this column is for customers of life insurance who wish to move from the desire for protection to acquiring it.

Low Cost

Very low term insurance costs are accomplished by separating prospective insureds into 3 classifications: super-perferred, preferred, and requirement. Generally, a super-preferred rating is earned by not using tobacco and having excellent to excellent height/weight ratios, blood values, health history, individual practices, and family health history. A lower preferred rating is earned when a couple of of the locations needed for super-preferred are a bit weaker. Requirement is offered to insureds who have greater weaknesses in any of the essential underwriting locations. Provided the exceptional health of super-preferreds and the restricted protection duration, these policies are comparable to unexpected death insurance coverage.

You should understand that some aggressive online marketers of affordable term insurance will advertise or estimate term costs based upon their super-preferred score category despite the real health of a certain possible insured. This possible dichotomy in between the quoted super-preferred cost and the real cost after the underwriting process has been completed has actually triggered some customers to feel like they have actually been victims of a mindful bait-and-switch strategy because a preferred score is usually one-third higher in cost than super-preferred, while standard is twice the expense.

Duration and Conditions

5-, 10-, 15- and 20-year level term policies are the most typical. The level term classification implies the expense remains constant for the duration of time designated. Numerous level term policies' premiums are ensured for the specified period of time. Numerous can be renewed after the specific amount of time with evidence of ongoing health or the expense to continue protection can be extremely high. The renewal cost will not be understood ahead of time since business change them at their discretion. Numerous policies can be converted, without additional proof of health, to irreversible policies the business so designates.

Likewise readily available are annual renewal term [ART] policies, whose expenses go up incrementally each year. ART is suitable when the protection is just needed for less than 5 years. For example, a creditor might require insurance protection on a credit line to a small company for a short time period. ART would likewise be the much better choice if the insured means to convert to irreversible coverage within 5 years when his cash flow improves.

Term life insurance is the suitable insurance coverage approach for these scenarios:

Family Protection

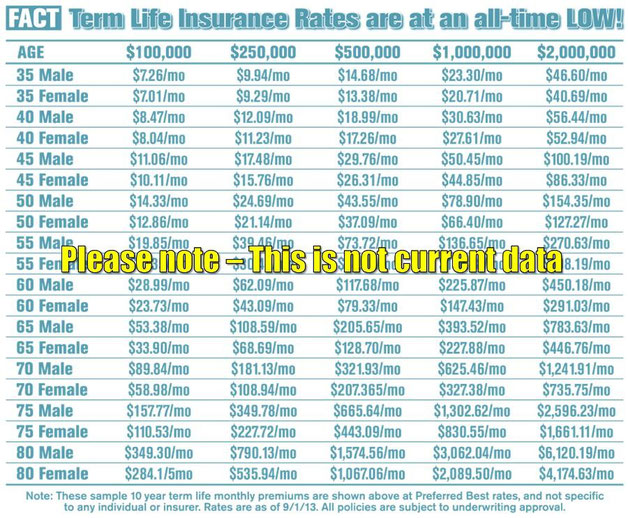

The primary purpose for life insurance is to offer defense to those financially depending on you. Let's think about Matt Green, a recently licensed internist taking his first post-training task. Matt's wife does not work outside the home, and they have 2 little ones. His yearly wage is $100,000. Without much calculation, he identifies he wants to protect his family with $2.0 million worth of life insurance. He isn't really thinking about considering any expensive life insurance or tax planning, so he contacts one of the companies marketing inexpensive term insurance, complies with their underwriting requirements, gets a super-preferred rating. He acquires a 10-year level term policy for $2.0 million at an annual expense of $630, which is less than the device expense for group policies through such expert companies as the American Medical Association. Matt's mindset is: With little expense in time or cash, he can now forget abou t his life insurance requires for 10 years.

Fund Buy-Sell Agreements

Business owners frequently have arrangements that obligate either each other or business entity to acquire a departed partner's interest in business (See the April and August 1997 AAII Journal Insurance Products columns that went over buy-sell arrangements and life insurance). Such commitments should be moneyed with life insurance. For business owners who have limited cash circulation or intend on selling or liquidating the company within a specific period, term insurance is a good alternative.

Estate Liquidity

Usually, estate liquidity life insurance is held up until the death of the guaranteed(s), so term insurance isn't really naturally cost efficient. That is, when the life insurance will certainly be held up until death and the guaranteed lives to life span or beyond, term insurance will certainly probably become too costly. Nevertheless, in cases where estate owners have extremely illiquid possessions that are most likely to be sold or liquidated within a provided time period and personal capital is a problem, using term insurance as a short-lived liquidity fund is an excellent idea. As soon as the illiquid possessions have been sold or liquidated, the estate owner then might think about transforming the term insurance to an irreversible kind of life insurance, possibly as a wealth transfer asset.

Policy Replacements

The cost, primarily for the level term policies, has actually been on a downward trend (occasionally approaching a spiral) for the previous decade. Since of this, lots of purchasers of level term policies have actually changed their policies before the level term duration ends. Comparing costs is simple. Nevertheless, there are two intangibles to think about before going on with the policy replacement. First, for the replacement policy, there is a new two-year period during which if death happens the insurance business will certainly examine to determine whether there were any misrepresentations on the insurance coverage application. If they can prove there were, they will attempt to reject the claim. Likewise, if death is by suicide, no benefits are paid during the very first 2 years. Second, consider the quality of the company and expense of transforming to a long-term policy. Typically, the quality of the business isn't really as much of a concern with guaranteed-cost term insurance, but it is with long-term insurance coverage. And, converting to a full-load irreversible policy is less bring in ive than being able to convert to a low-load permanent policy.

Premium Guarantees

I am not familiar with any term policies' guaranteed premiums being changed or death benefits not being paid, a minimum of during this century. However level term insurance is so competitive, with lower and lower rates coming out, that it wouldn't amaze me if some business wind up being taken by regulators due to solvency concerns. If that were to occur, we would remain in uncharted waters regarding the effects it would have on policy owners. My suggestions is that, besides expense, you should consider the quality of the business, and particularly the amount of inexpensive term insurance the business offers as a percentage of its other life insurance business.

Purchasing Term Insurance

Previously this year, Ameritas Life Insurance Corporation, through its low-load direct-to-consumer-unit Veritas (800/552 -3553), began marketing and selling 10- and 20-year level term insurance with some of the most affordable premium costs readily available.

As an option to Ameritas, you can call Insurance Information (800/472 -5800) and for a $50 cost they will provide you the names of insurance business (consisting of Ameritas) with the most affordable rates based upon your specific circumstance.

Poka Yoke For Dummies

What is Poka Yoke?

Poka Yoke, developed by Shigeo Shingo, aims to eliminate defects by preventing, correcting, or drawing attention to human errors as they occur. The concept is straightforward: make it hard to make a mistake and easy to fix if one does happen.

Everyday Examples

Think of your washing machine. It won't start if the door is open. That's Poka Yoke in action. Or consider your car. If you forget to buckle up, the car beeps. These simple mechanisms stop mistakes in their tracks.

Types of Poka Yoke

There are two main types of Poka Yoke: prevention and detection.

1. Prevention

This type stops errors from happening in the first place. For instance, USB drives only fit one way. You can’t plug them in upside down. Similarly, three-pin power plugs are designed so they only fit the socket one way, ensuring you don't connect the wrong pins.

2. Detection

This type catches errors after they occur but before they cause issues. For example, spell check in word processors catches typos. In manufacturing, sensors might detect if a part is missing before the product moves to the next stage.

How to Implement Poka Yoke

Implementing Poka Yoke isn’t rocket science. It requires a bit of creativity and a lot of common sense. Here’s how you can start:

1. Identify Common Errors

First, figure out where mistakes happen. Talk to employees, review quality reports, and observe processes. For instance, if workers frequently assemble parts incorrectly, that’s a starting point.

2. Analyze the Cause

Next, dig into why these errors occur. Maybe workers are rushing because of tight deadlines, or the instructions aren’t clear. Understanding the root cause is crucial.

3. Develop a Solution

Now, brainstorm ways to prevent these mistakes. Solutions should be simple and inexpensive. For example, use color-coded parts that only fit together one way, or add jigs and fixtures that guide parts into the correct position.

4. Test and Refine

Once you’ve developed a solution, test it out. Gather feedback from workers and make adjustments as needed. Ensure the solution actually prevents errors and is user-friendly.

Real-World Applications

1. Toyota

Toyota is a master of Poka Yoke. In their factories, they use countless mistake-proofing devices. One example is a fixture that ensures only correctly assembled parts move to the next stage. If something’s wrong, the line stops automatically, prompting immediate correction.

2. Healthcare

In hospitals, medication errors can be fatal. To combat this, some hospitals use barcoding systems. Nurses scan the patient’s wristband and the medication. If there’s a mismatch, an alert pops up, preventing potential errors.

3. Retail

Retail stores use Poka Yoke to improve customer service. Self-checkout machines, for instance, won’t let you proceed if you haven’t bagged an item, ensuring you don’t forget anything.

Benefits of Poka Yoke

The benefits are clear. Poka Yoke enhances quality, boosts efficiency, and reduces costs. By preventing errors, you save time and money on rework and repairs. It also improves safety, reducing the risk of accidents and injuries. Plus, it empowers employees by making their jobs easier and less stressful.

Poka Yoke is a powerful tool for improving processes and preventing errors. It’s all about making things foolproof. Whether it’s in manufacturing, healthcare, or your daily life, mistake-proofing can save time, money, and headaches. So next time you’re faced with a recurring problem, think Poka Yoke. Simple changes can make a big difference. After all, as the saying goes, "An ounce of prevention is worth a pound of cure."

When Were Taguchi Methods Taken Up By American Industry?

The Early Years

Genichi Taguchi began developing his methods in the 1950s, focusing on improving product quality by making designs less sensitive to variations in manufacturing. His approach was innovative, emphasizing the importance of design in reducing defects rather than merely inspecting finished products. Taguchi's methods gained traction in Japan, particularly within companies like Toyota, which were committed to quality and efficiency.

The American Awakening

The American industry started to seriously look at Taguchi Methods in the late 1970s and early 1980s. During this period, American manufacturers were grappling with increasing competition from Japanese companies, known for their high-quality products and efficient manufacturing processes. The U.S. auto industry, in particular, was under pressure. Japanese cars were outperforming American models in terms of reliability and customer satisfaction.

The Ford Example

One of the first American companies to embrace Taguchi Methods was Ford Motor Company. In the early 1980s, Ford was looking for ways to improve quality and reduce costs. Engineers at Ford began exploring Taguchi's techniques and soon realized their potential. By focusing on design improvements and robust testing, Ford managed to enhance the quality of its vehicles. This success story was documented in several industry journals and quickly caught the attention of other manufacturers.

The 1984 AT&T Bell Laboratories Workshop

A significant milestone in the adoption of Taguchi Methods in America was the 1984 workshop held at AT&T Bell Laboratories. This event brought together leading quality control experts and introduced them to Taguchi's techniques. According to a report by Quality Digest, this workshop played a crucial role in spreading the Taguchi philosophy across various industries. Participants were impressed by the practical applications and tangible benefits of these methods.

Widespread Adoption

Following the success at Ford and the influential AT&T workshop, more American companies began to implement Taguchi Methods. By the late 1980s, industries ranging from electronics to pharmaceuticals were experimenting with these techniques. The appeal was clear: improved quality, reduced costs, and a more systematic approach to problem-solving. Thus, this technique was one of a number utilised in ISO 9001 quality management systems all around the world.

The Role of Education and Training

The proliferation of Taguchi Methods in the U.S. was also fuelled by an increasing emphasis on quality management education. Business schools and engineering programs began incorporating Taguchi's principles into their curricula. Additionally, companies invested in training their employees to apply these methods effectively. Workshops, seminars, and certification programs became commonplace, further embedding Taguchi's ideas into American manufacturing culture.

Real-World Applications

Let’s look at a couple of real-world applications:

1. Hewlett-Packard (HP)

In the 1990s, HP adopted Taguchi Methods to improve the quality of their printers. By focusing on design optimization and robust testing, HP managed to significantly reduce defects and improve customer satisfaction. This approach not only enhanced product reliability but also boosted the company's reputation for quality.

2. Xerox

Xerox, another early adopter, used Taguchi Methods to refine their photocopiers. By applying these techniques, Xerox was able to identify and mitigate potential problems during the design phase, leading to more reliable and cost-effective products. This helped Xerox maintain its competitive edge in the market.

The Lasting Impact

Today, Taguchi Methods are a staple in many American manufacturing processes. The principles of robust design and minimizing variation have been integrated into broader quality management frameworks like Six Sigma and Lean Manufacturing. The legacy of Taguchi’s work is evident in the high standards of quality and efficiency that define modern American industry.

The adoption of Taguchi Methods by American industry was a turning point in the quest for quality and efficiency. Sparked by the competitive pressures of the late 1970s and fuelled by success stories like Ford and workshops like the one at AT&T Bell Laboratories, these methods found fertile ground in the United States. Through education, training, and real-world applications, Taguchi's principles have become deeply embedded in the fabric of American manufacturing, driving innovation and excellence for decades.

You can do it, too! Sign up for free now at https://www.jimdo.com